Chargeback Relief: Does It Go Far Enough? Is It Fair to Issuing Banks?

Reacting to strong complaints from retailers, three major card brands have finally taken steps toward reducing the amount of counterfeit fraud...

Reacting to strong complaints from retailers, three major card brands have finally taken steps toward reducing the amount of counterfeit fraud chargebacks to U.S. merchants, which began as a result of the EMV fraud liability shift last October.

Visa and AmEx are both saying they will prevent issuers from holding merchants liable for counterfeit fraud chargebacks on transactions of less than $25. They also say that issuers will be limited to 10 chargebacks per card, with issuers assuming the liability for fraudulent transactions after the 10-chargeback limit.

Reacting to strong complaints from retailers, three major card brands have finally taken steps toward reducing the amount of counterfeit fraud...

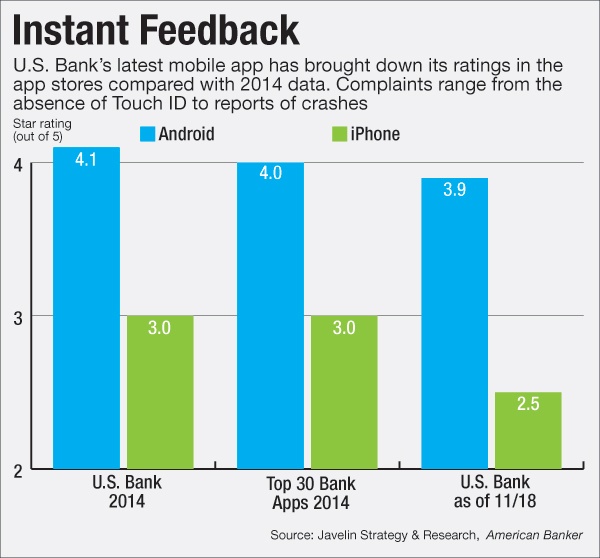

U.S. Bank's updated mobile app was perhaps not up-to-date enough for its critics. "Why isn't Touch ID supported yet? This is the one thing I was...

Mastercard will be launching an app that uses a 'selfie' to authenticate the user later this year. Will community banking apps follow suit in the...